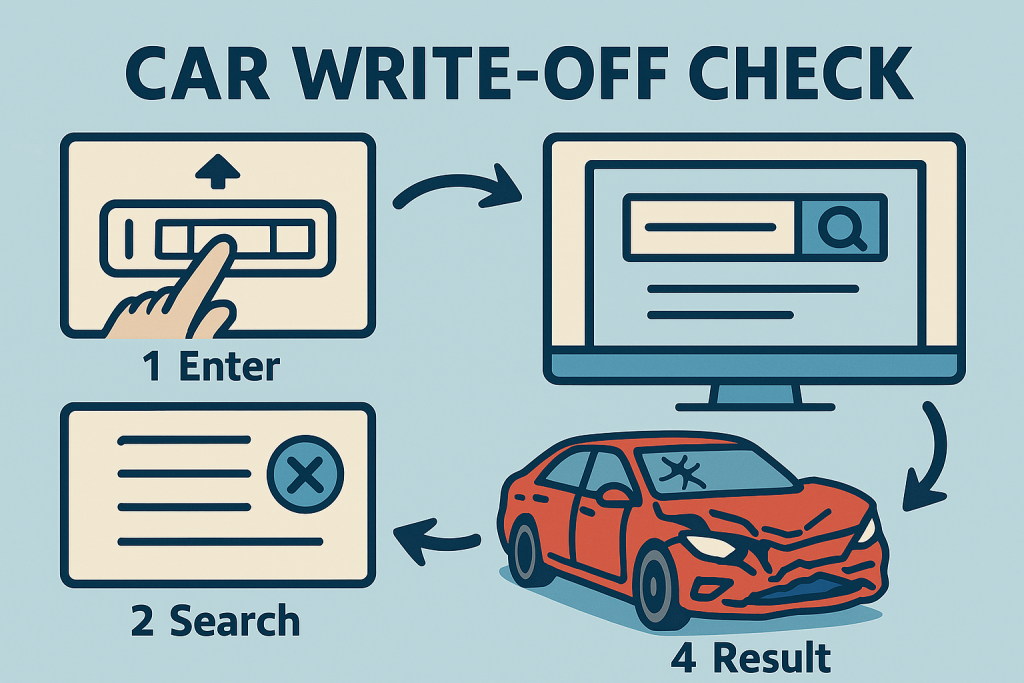

Car Write Off Check

- Instantly check if a car’s been written off by insurance using just the reg number.

- Get access to official DVLA data for accurate write-off categories like CAT A, B, S and N.

- Find out the damage history and see if it’s safe to buy that second-hand motor.

- Check MIAFTR database records for written-off and stolen vehicles across the UK.

- Get instant results for any British car regardless of age or what fuel it runs on.

- Avoid nasty surprises when buying cars that’ve been in crashes or had major damage.

- Quick and reliable checks from the car industry experts at MOTchecker.

Trial for 48 hours fully unrestricted access for just 50p. Continued membership charged at £7.99 per month thereafter.

When it comes to purchasing a used vehicle, conducting a thorough write off check is not just advisable—it’s essential. As someone who has spent decades in the automotive industry, I’ve witnessed countless buyers fall victim to purchasing vehicles with hidden write-off histories, resulting in significant financial losses and safety concerns.

At MOTchecker, we understand that checking if a car has been written off requires more than just a cursory glance at the vehicle’s exterior. Our comprehensive car write off check service provides you with the critical information needed to make informed purchasing decisions, protecting both your investment and your safety on UK roads.

Understanding vehicle write-Offs: The foundation of smart car buying

A vehicle write-off occurs when an insurance company determines that the cost of repairs exceeds the vehicle’s current market value, or when the damage renders the vehicle unsafe for road use. This classification system exists to protect consumers and ensure road safety standards are maintained across the UK.

The current write-off categories, established by the Association of British Insurers (ABI), are designed to clearly indicate the severity of damage and the vehicle’s roadworthiness potential:

| Category | Description | Road Legal Status | Repair Possibility |

|---|---|---|---|

| Category A | Total destruction required | Never road legal | Cannot be repaired |

| Category B | Body shell must be crushed | Never road legal | Parts may be salvaged |

| Category S | Structural damage sustained | Can return to road | Professional repair required |

| Category N | Non-structural damage | Can return to road | Professional repair required |

Understanding these categories is crucial when performing an insurance write off check, as they directly impact the vehicle’s value, safety, and legal status.

The critical importance of Write-Off verification

Checking if a car has been written off serves multiple essential purposes that extend far beyond simple due diligence. From my experience in the industry, I’ve observed that approximately one in three used vehicles carries some form of hidden history that could significantly impact the buyer’s decision.

Financial protection

When you check if car has been written off, you’re protecting yourself from substantial financial losses. Written-off vehicles typically experience significant depreciation, and purchasing such a vehicle without knowledge of its history can result in immediate equity loss. Furthermore, insurance companies may refuse coverage or charge substantially higher premiums for vehicles with write-off histories.

Safety considerations

Vehicles that have sustained structural damage (Category S) require professional assessment and repair before they can safely return to the road. Without proper car write off check procedures, you risk purchasing a vehicle that may have compromised safety systems, potentially endangering you and other road users.

Legal compliance

The Driver and Vehicle Licensing Agency (DVLA) maintains strict requirements regarding written-off vehicles. Failure to properly register a repaired write-off or attempting to use a Category A or B vehicle on public roads constitutes a serious legal violation that can result in prosecution and substantial fines.

MOTchecker’s advanced Write-Off detection system

Our vehicle write off check service at MOTchecker employs sophisticated algorithms and comprehensive database access to provide you with detailed, accurate information about any vehicle’s history. Unlike basic free services that may miss critical information, our system performs deep searches across multiple authoritative sources.

Comprehensive database access

Our car write off checker accesses:

- Current and historical insurance databases

- DVLA records and classifications

- Police National Computer (PNC) stolen vehicle records

- Finance and hire purchase agreements

- Import/export documentation

- Auction house records

Real-Time verification

When you check if a car has been written off using our service, you receive real-time data that reflects the most current information available. This ensures that recent write-offs or status changes are immediately reflected in your report.

Detailed category analysis

Our reports don’t simply indicate whether a vehicle has been written off—they provide detailed analysis of the write-off category, the nature of the damage, and the implications for the vehicle’s current status and value.

Understanding the Write-Off Process and Your Rights

Insurance Assessment Procedures

When an accident occurs, insurance assessors evaluate the damage against the vehicle’s current market value. If repair costs exceed approximately 50% of the vehicle’s worth, the insurer will typically declare it a write-off. This threshold ensures that economically unviable repairs aren’t undertaken, protecting both insurers and policyholders.

DVLA Notification Requirements

Vehicle owners must notify the DVLA when their vehicle has been written off and scrapped by their insurance company. Failure to comply with this requirement can result in fines of up to £1,000. This notification process ensures that the DVLA’s records accurately reflect the vehicle’s status.

Buying Back Written-Off Vehicles

For Category S and N vehicles, owners may have the option to buy back their written-off vehicle from the insurance company. This process requires:

- Negotiating a buy-back price with the insurer

- Arranging professional repairs to roadworthy standards

- Obtaining a valid MOT certificate

- Re-registering the vehicle with the DVLA

- Securing appropriate insurance coverage

Red Flags: Identifying Potential Write-Offs

Visual Inspection Indicators

When examining a potential purchase, several visual cues may indicate previous write-off status:

- Paint inconsistencies: Variations in paint color or texture may indicate bodywork repairs

- Panel alignment issues: Gaps between panels or misaligned components suggest structural work

- Welding marks: Visible welding, particularly on structural components, may indicate significant repairs

- Interior wear patterns: Excessive wear inconsistent with the vehicle’s age or mileage

Documentation Anomalies

Careful review of vehicle documentation can reveal important information:

- V5C logbook irregularities: Recent issue dates or multiple keeper changes may indicate write-off history

- Service history gaps: Missing service records during specific periods may coincide with accident repairs

- Insurance documentation: Reluctance to provide insurance details or claims history should raise concerns

Conclusion: Protecting your investment through due diligence

In my four decades of experience in the automotive industry, I’ve learned that knowledge is the most powerful tool in making sound vehicle purchasing decisions. A comprehensive write off check isn’t just about avoiding problematic vehicles—it’s about understanding exactly what you’re purchasing and making informed decisions based on complete information.

At MOTchecker, we’re committed to providing you with the most comprehensive, accurate, and up-to-date vehicle history information available. Our car write off check service represents decades of industry expertise combined with cutting-edge technology, ensuring that you have access to the critical information needed to protect your investment and ensure your safety on UK roads.

Remember, when it comes to vehicle purchases, the cost of a thorough check is insignificant compared to the potential consequences of buying a vehicle with hidden write-off history. Don’t leave your safety and financial security to chance—verify before you buy.

For official guidance on vehicle write-offs and DVLA requirements, visit the Government’s official guidance on scrapped and written-off vehicles and the DVLA notification service for written-off vehicles.

FAQ

Q: What exactly is a car write-off?

A: A car write-off occurs when an insurance company determines that the cost of repairing a damaged vehicle exceeds its current market value, or when the damage makes the vehicle unsafe for road use. The vehicle is then classified into one of four categories (A, B, S, or N) depending on the severity and type of damage sustained.

Q: How do I check if a car has been written off?

A: The most reliable method is to use a professional vehicle history service like MOTchecker, which accesses multiple databases including insurance records, DVLA information, and police databases. You can also check directly with the DVLA for certain information, though their public records are limited. Always request documentation from the seller regarding any insurance claims or accident history.

Q: Can I get a free write-off check?

A: While some basic information may be available through free services, comprehensive write-off checks require access to premium databases that incur costs. Free services often miss critical information or provide outdated data. At MOTchecker, we believe that the small cost of a professional check is insignificant compared to the potential financial and safety risks of purchasing a vehicle with hidden write-off history.

Q: Is it legal to drive a written-off car?

A: This depends entirely on the write-off category:

- Category A & B: Never road legal and cannot be repaired for road use

- Category S & N: Can return to the road after professional repair, MOT certification, and proper DVLA registration